*Please use the slider to select your debt amount

or Talk to a Texas Debt Specialist 210-782-8100

or Talk to a Texas Debt Specialist

210-782-8100

Eliminate high-interest Credit Card Debt in as little as

24 - 48 months

Eliminate high-interest Credit Card Debt

in as little as 24 - 48 months

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for reduced interest or negotiated balance reductions

- Call: 210-782-8100 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for interest reductions or negotiated balance reductions

- Call: 210-782-8100 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

Debt Settlement Sanantonio, Texas: 4 Things to Keep in Mind

One risk of choosing debt settlement is that a creditor could choose not to negotiate. However, this is extremely rare since all major creditors negotiate as standard practice. The actual savings achieved can vary between the creditors you owe, your financial hardship, and the quality of the company providing you the services.

Know the Risks

When you hear about debt settlement in Sanantonio, Texas, it might sound too good to be true. However, knowing the risks will help you evaluate this financial tool much more carefully. You need to weigh the pros and cons between a debt consolidation loan (if you can qualify), credit counseling, debt relief, and bankruptcy, assuming you meet the federal requirements to file.

Pick the Right Company

You don’t want to take risks with your money. If you’re already overwhelmed, trying to manage your debts, finding a reputable service provider for debt relief options like debt settlement, debt management plans, and debt consolidation in Sanantonio, Texas is a must. You need a reliable team of experts to help you. There are a lot of out-of-state companies taking advantage of Texans with promises too good to be true and high fees. Researching Accredited companies in Texas with the Better Business Bureau will give you a much better chance of finding a reputable company with low fees.

Be Informed of Your Rights

Before you say yes to an agreement with a debt settlement company, find out what your rights are. What are you entitled to? If the company is already charging you fees upfront, that’s a violation of the Federal Trade Commission rules. Know that it’s not supposed to be like that. By being clear about your rights, you won’t be abused. Be on the lookout for abusive practices, too, so you can steer clear of those service providers.

Talk to Your Family

Are you able to borrow the money to pay back your debt with a zero percent interest loan? Remember, taking loans from friends or family members can damage relationships if things go sour in the future. If you are already struggling and falling behind, you may want to compare bankruptcy to debt settlement. Sometimes debt settlement is less expensive compared to chapter 13 bankruptcy, and sometimes it will be more. If you meet the criteria to qualify for chapter 7, it is the quickest way out of debt, but bankruptcy can have future consequences.

How to Receive Debt Consolidation

Affordable Debt Consolidation Headquarters

- 210-782-8100

- 300 Convent St Suite 1330, San Antonio, TX 78205

Hours of Operation

- Mon - Sat: 6 AM – 10 PM CT

- Sun: 7 AM - 10 PM CT

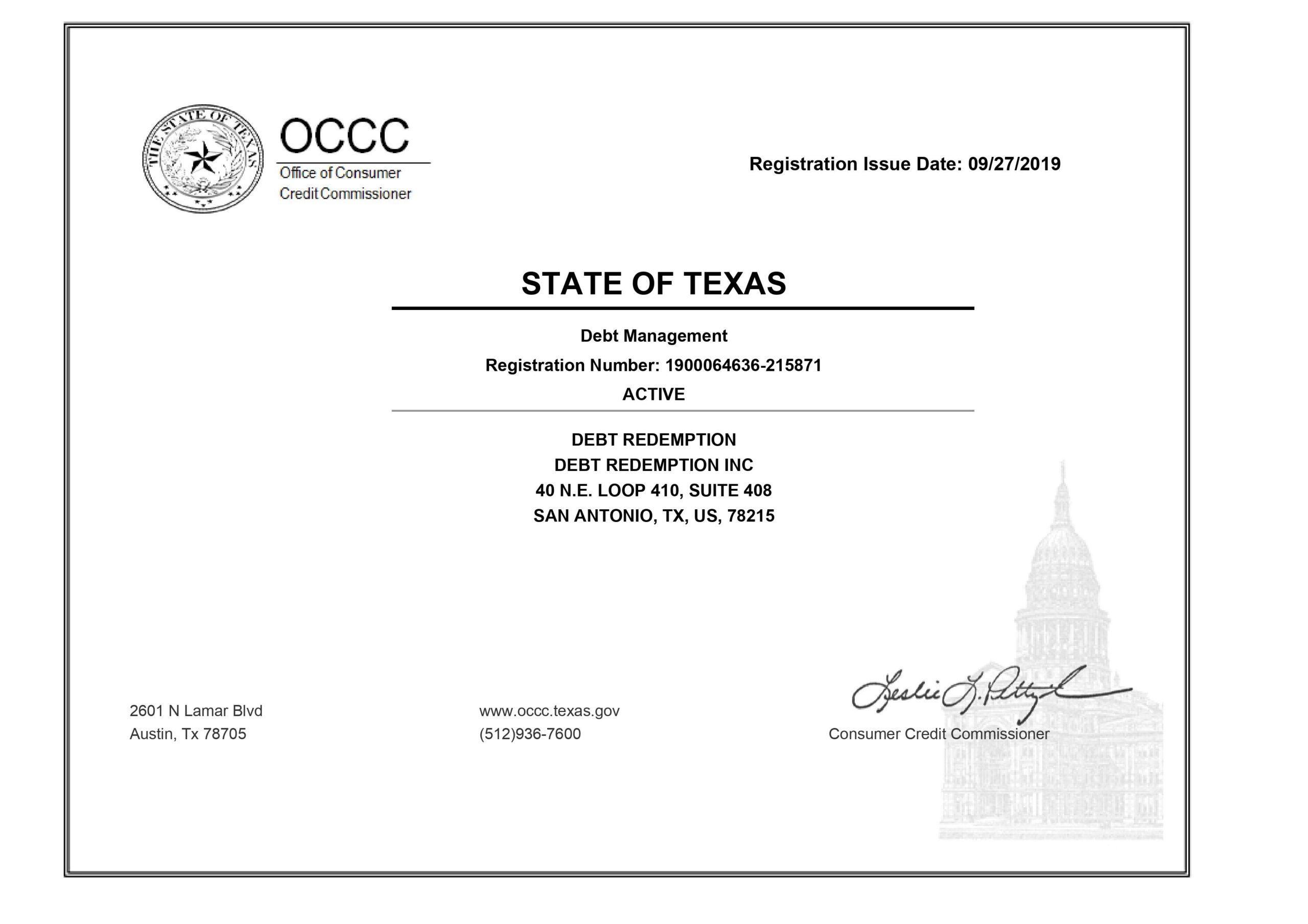

Texas Debt Management License

Debt Redemption License

Debt Consolidation San Antonio Texas and San Antonio Texas Debt Relief Consultations are Free of Charge with no obligation. Credit counseling clients generally obtain an interest rate between 6% and 11%. Debt negotiation clients who make monthly program payments generally experience approximately a 50% reduction of their enrolled balance before fees, or approximately a 35% reduction after payment of settlement fees over a 24-48 month period, not including optional and separate services such as legal representation provided by San Antonio law firm.

Individual results vary based on ability fund program and the creditors enrolled. Statements made are examples of past performance and are not intended to guarantee that your balances will be reduced by a specific amount or that you will resolve debt within a specific time period. Settlement fees are not charged until a debt is reduced and a payment has been made to creditor. We do not assume consumer debt, make monthly payments, provide tax or legal advice. We are not a credit repair firm. Please contact a tax professional to discuss any possible tax consequences of paying less than the full balance. Programs available in Texas. Logos used are property of their respective owners.

Privacy Policy | © Copyright Affordable Debt Consolidation San Antonio Texas 2024 | All Rights Reserved | Sitemap