*Please use the slider to select your debt amount

or Talk to a Texas Debt Specialist 281-612-3888

or Talk to a Texas Debt Specialist

281-612-3888

Eliminate high-interest Credit Card Debt in as little as

24 - 48 months

Eliminate high-interest Credit Card Debt

in as little as 24 - 48 months

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for reduced interest or negotiated balance reductions

- Call: 281-612-3888 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for interest reductions or negotiated balance reductions

- Call: 281-612-3888 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

Debt Settlement in League City Texas- Is It the Way Out?

Debt settlement is a debt relief program that allows you to pay less than you owe. However, it works well when you pay a lump sum amount and a company will help you set up an account to save money for the settlements. Although you can do it alone, a debt relief company negotiates with your creditors and convinces them to let you pay a little less than what you owe. However, it doesn’t work with loans that have collateral, mortgages, or car loans unless the collateral was repossessed or foreclosed. Usually, this plan works with credit cards when there’s little hope you’ll be pay the debt in full. These programs can offer a program payment that is often less than half compared to minimum payments, and resolve the debt in as little as 24 to 48 months in many cases.

But, this program has some risks, and you should only take it as a last resort. Here are the risks for debt settlement.

It can negatively impact your credit Score

In most instances, debt settlement works when you cannot make monthly payments. This automatically hurts your credit score. If you’re working with a debt settlement company in League City, they can ask you to stop making monthly payments to help in negotiations. Therefore, your credit score will decline, unless you are already behind. Of course if you expect to fall behind in the future, getting ahead of it sooner than later is better

Once your debt is resolved, your debt-to-income ratio will improve, and you can quickly start restoring your credit standing. If you stay on-time with your mortgage, car payment and other secured debt, it will also help your score to rapidly recover once your debt is resolved

Forgiven could be taxable income

The amount your creditor takes off your debt is known as forgiven debt. While this might be a relief, the law could require you to pay tax on this amount if it exceeds $600. For this reason, you might get in trouble with the IRS if you fail to pay the tax. However, the IRS offers a form 982 to apply for exemption from needing to pay income taxes on the forgiven debt amount. Many people are able to use this method to avoid any additional taxes, but even if you had to pay some taxes on the forgiven debt amount, it is far, far better than paying the debt in full plus interest. Many creditors may not send you a 1099C which means the creditor is not clamming the forgiven debt to the IRS. Likely, the collection agency only paid pennies on the dollar for the debt when they purchased it from the original creditor.

It's not an Easy Way Out

Debt settlement isn’t a quick fix to your debt problems. First, unlike debt consolidation in League City, with debt settlement, you must deposit money into a special purpose account, although this amount could be less than half compared to minimum payments. Some people can complete the program in as little as six months but 36 to 48 months is a common length. Minimum payments could take a decade or more to pay off debt.

Debt settlement can help you get out of debt and avoid bankruptcy in many cases, but it is not a perfect solution. There is no perfect solution unless you have the resources to pay off all of your debt. Otherwise you may pay much more than you owe in interest

How to Receive Debt Consolidation in League City, Texas

The fastest way to get help is to call to speak with a Texas Debt Specialist now. You may also fill out the form above and one of our Texas Debt Specialists will reach out to provide you with a free and no-obligation consultation for Debt Relief or Debt Consolidation in League City, Texas.

Affordable Debt Consolidation Headquarters

Hours of Operation

- Mon - Sat: 6 AM – 10 PM CT

- Sun: 7 AM - 10 PM CT

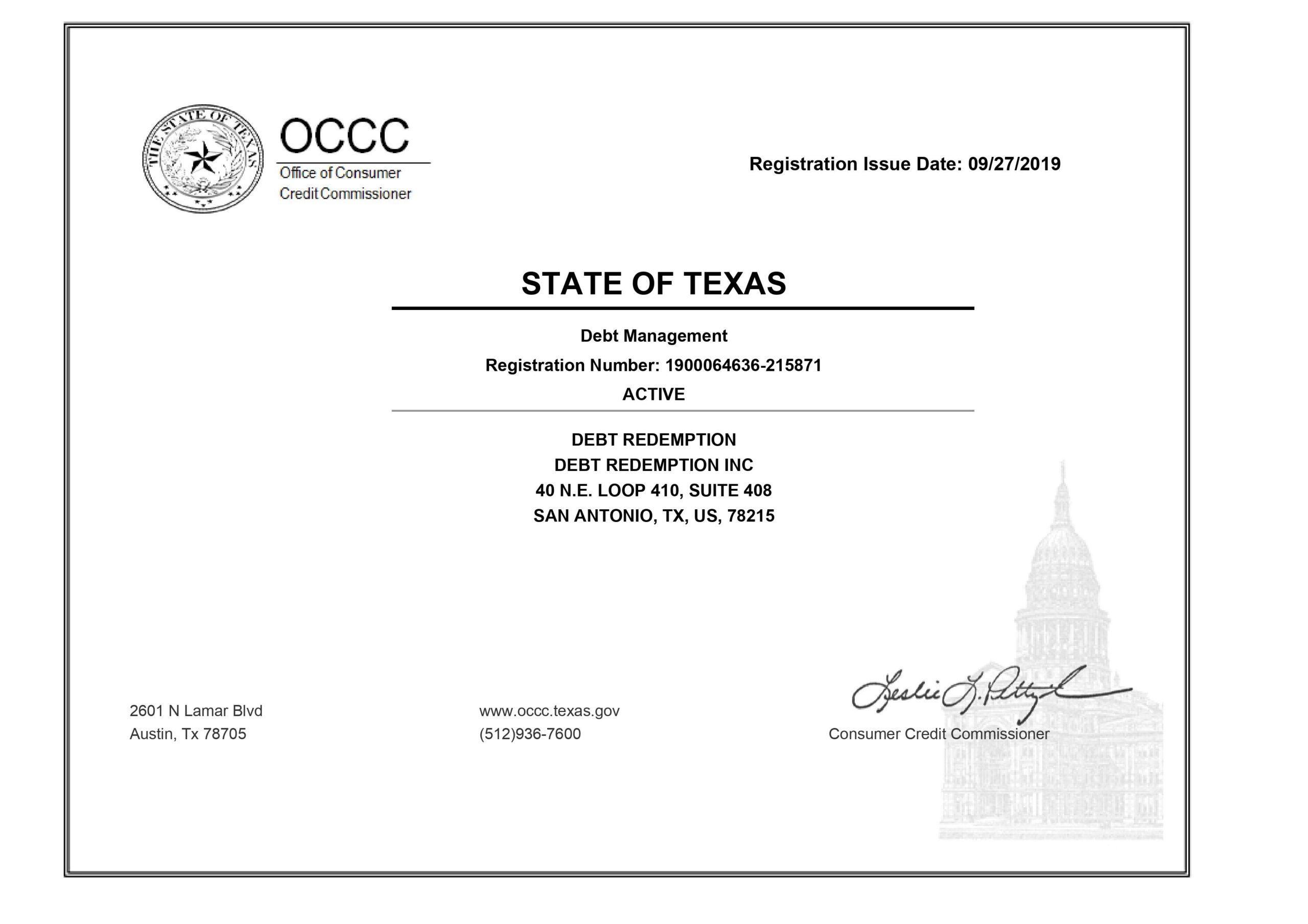

Texas Debt Management License

Debt Redemption License

Debt Consolidation League City, Texas, Credit Counseling League City, Texas, and Debt Relief League City, Texas Consultations are Free of Charge with no obligation. Affordable Debt Consolidation is not a lender but offers a platform to receive offers from participating lenders. Credit counseling clients generally obtain an interest rate between 6% and 11%. Debt negotiation clients who make their scheduled monthly program payments generally experience approximately a 45% reduction of their enrolled balance before fees over a 24-48 month period, not including any optional and separate services such as legal services provided by a law firm. Our settlement fees are 15% of the enrolled balance compared to 25% charged by most competitors. Individual results vary based on the ability to fund the program, and the creditors enrolled. Statements made are examples of past performance and are not intended to guarantee that your balances will be reduced by a specific amount or that you will resolve debt within a specific time period. Settlement fees are not charged until a debt is reduced and payment has been made to the creditor. We do not assume consumer debt, make monthly payments, or provide tax or legal advice. We are not a credit repair firm. Please contact a tax professional to discuss any possible tax consequences of paying less than the total balance. Debt Relief programs are exclusively offered to Texas residents. Logos used are property of their respective owners.

Privacy Policy | © Copyright Affordable Debt Consolidation League City, Texas 2024 | All Rights Reserved | Sitemap