*Please use the slider to select your debt amount

or Talk to a Texas Debt Specialist 469-663-6222

or Talk to a Texas Debt Specialist

469-663-6222

Eliminate high-interest Credit Card Debt in as little as

24 - 48 months

Eliminate high-interest Credit Card Debt

in as little as 24 - 48 months

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for reduced interest or negotiated balance reductions

- Call: 469-663-6222 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for interest reductions or negotiated balance reductions

- Call: 469-663-6222 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

When is the Right Time to Consider Credit Counseling in Lancaster, Texas?

Debt repayment is not always easy if financial emergencies lead you into more borrowing. Debt counseling is great if you are behind on your payments and overwhelmed by late payment fees. The process is pretty simple, and a counselor will help you understand your debt repayment options. However, you never know when these services will help you, and today we look at key pointers suggesting you need debt counseling services.

What is Debt Counseling?

Credit counseling in Lancaster is a debt relief opportunity that involves one-on-one guidance from a certified counselor. They specialize in credit card debt, and their services are often free or low cost. Before meeting a debt counselor, you must outline your monthly expenses like utilities, food, and gas. It is also advisable to have financial paperwork like credit card and bank statements, pay stubs, and bills when necessary.

When is the Right Time for Debt Counseling?

Debt counseling services begin by signing a service agreement with a counselor and explaining your financial situation. You need to be upfront and honest because this is the only method to find solutions that work for you. Consider debt counseling if;

- You cannot pay your credit card and mortgage debts or seek help to meet financial goals.

- You are looking for free advice and resources for debt settlement options in Lancaster.

- You do not qualify for a consolidation loan for unsecured debt. However, a credit counseling agency will help you find the best debt management plan.

- You are considering purchasing a home, and you need pre-purchase counseling.

- You are swimming in debt and need to get a debt-relief plan in a crowded market.

How Will a Credit Counselor Help You?

A credit counselor will take note of your financial goals and collect information to help organize your finances. Then, they will guide you in developing a budget to create a personalized action plan to meet your goals. This process includes guidelines to improve credit ratings, repay unpaid debts, or achieve housing objectives. They may also advise on things to avoid to improve your scores.

Benefits of Debt Counseling

- Rebuilds your Credit Score

A credit counselor can help you get on the right track even if you are behind on your payments.

- Reduces debt-related costs

Your credit counselor will suggest a debt management plan, including negotiating plans with your creditors. You can make monthly payments to the counseling agency that pays creditors on your behalf.

- Boosts your financial health

Debt counseling also guides you accordingly on your finances by assessing income and expenses. You can therefore create a budget that meets your needs.

Consider an agency in your best interests if you are considering credit counseling services. Doing this ensures you find a provider who cares about your financial well-being. As a result, you can once again claim control of your finances while retaining positive credit.

What a credit counselor cannot do

A credit counselor does not provide debt consolidation loans, although the credit counselor can review your credit and give you an idea if you might be able to qualify for one. While credit counselors do provide bankruptcy counseling, you must seek a qualified Texas bankruptcy attorney if you want to pursue this option. Finally, most credit counselors do not offer or recommend debt settlement. Credit counselors are mostly funded by the creditors that they collect payments for, and creditors would rather receive the full balance plus some interest in comparison to debt negotiation. In debt negotiation, a company representing your sole interest (not the creditors) will negotiate for the largest possible reduction of your balance. This benefits you much more than a credit counseling program and is why many people are turning to this option. But credit counseling could be a better option for some situations. Research the Better Business Bureau for a credit counselor or debt settlement company to help you. Texas has fee caps for both credit counseling and deb settlement so going with a Texas-based company might save you money.

How to Receive Debt Consolidation in Lancaster, Texas

The fastest way to get help is to call to speak with a Texas Debt Specialist now. You may also fill out the form above and one of our Texas Debt Specialists will reach out to provide you with a free and no-obligation consultation for Debt Relief or Debt Consolidation in Lancaster, Texas.

Affordable Debt Consolidation Headquarters

Hours of Operation

- Mon - Sat: 6 AM – 10 PM CT

- Sun: 7 AM - 10 PM CT

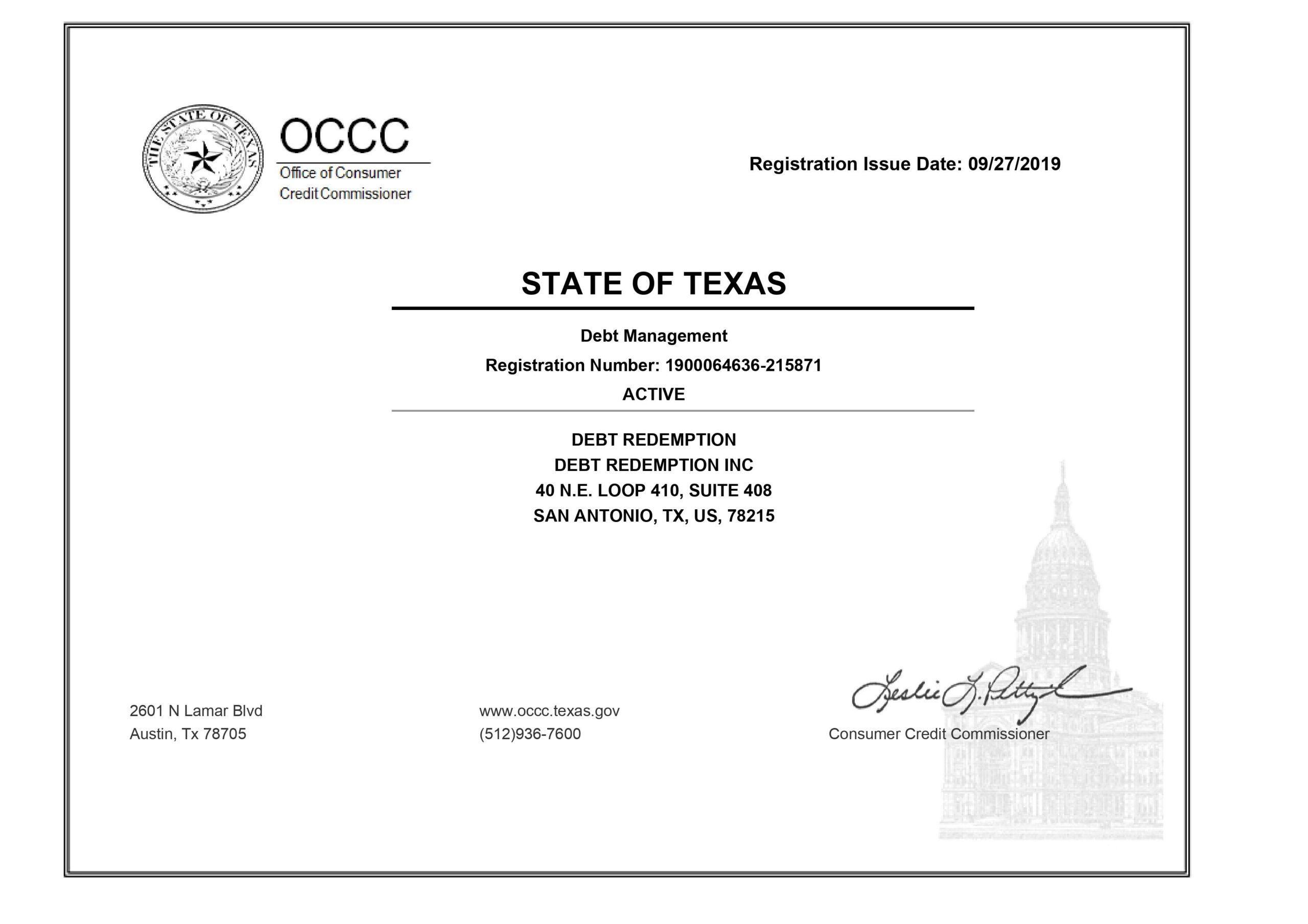

Texas Debt Management License

Debt Redemption License

Debt Consolidation Lancaster, Texas, Credit Counseling Lancaster, Texas, and Debt Relief Lancaster, Texas Consultations are Free of Charge with no obligation. Affordable Debt Consolidation is not a lender but offers a platform to receive offers from participating lenders. Credit counseling clients generally obtain an interest rate between 6% and 11%. Debt negotiation clients who make their scheduled monthly program payments generally experience approximately a 45% reduction of their enrolled balance before fees over a 24-48 month period, not including any optional and separate services such as legal services provided by a law firm. Our settlement fees are 15% of the enrolled balance compared to 25% charged by most competitors. Individual results vary based on the ability to fund the program, and the creditors enrolled. Statements made are examples of past performance and are not intended to guarantee that your balances will be reduced by a specific amount or that you will resolve debt within a specific time period. Settlement fees are not charged until a debt is reduced and payment has been made to the creditor. We do not assume consumer debt, make monthly payments, or provide tax or legal advice. We are not a credit repair firm. Please contact a tax professional to discuss any possible tax consequences of paying less than the total balance. Debt Relief programs are exclusively offered to Texas residents. Logos used are property of their respective owners.

Privacy Policy | © Copyright Affordable Debt Consolidation Lancaster, Texas 2024 | All Rights Reserved | Sitemap