*Please use the slider to select your debt amount

or Talk to a Texas Debt Specialist 469-663-6222

or Talk to a Texas Debt Specialist

469-663-6222

Eliminate high-interest Credit Card Debt in as little as

24 - 48 months

Eliminate high-interest Credit Card Debt

in as little as 24 - 48 months

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for reduced interest or negotiated balance reductions

- Call: 469-663-6222 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for interest reductions or negotiated balance reductions

- Call: 469-663-6222 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

Credit Counseling in Frisco, Texas

Credit counseling services in Frisco help many consumers avoid bankruptcy. These credit counselors advise their clients on how to budget and manage their income. They may also educate consumers on how to approach their creditors on matters of the debt settlement or payment plans and walk them through the procedure. One of their services is a debt management plan to provide lower interest rates and one easy to manage payment to the credit counselor.

Certified credit counselors in Frisco, Texas, educate consumers on the causes of debt and offer tools that can help one to avoid late mortgage payments, dormant saving accounts, and maxed-out credit cards.

Counselors offer different solutions to their consumers based on their unique situations. Some counselors may suggest a debt management plan, while others may direct you to debt consolidation, bankruptcy, or debt settlement to solve your problems.

For credit counseling companies, the Foundation for Credit Counseling has imposed tough policy measures on counselor accreditation, data security, and customer service. Credit counselors help consumers to optimize their budget and how fully utilize their income. Debt settlement companies and credit counselors must be licensed in Texas and should be accredited by the Better Business Bureau.

Credit Counseling Frisco

Credit counseling firms in Frisco, Texas ensure their consumers have financial soundness by providing financial relief programs. These programs cushion consumers from debt accumulation by designing a tailored debt management plan suitable for any situation. Credit counselors educate consumers on how best to manage their income by providing a suitable budget.

In Frisco, licensed agencies offer to counsel to consumers who are over-indebted to release them from financial distress. They also offer solutions to consumers on how best they can manage to manage their debts.

Credit Counseling Frisco provides ways on how one can resolve their debts. They include:

- Debt Management Plan

Counselors give advice on how best you can handle your debts. They may offer a working plan based on your situation. This usually involves lowering the interest rates on your existing debts and making one payment to the creditor counselor, who distributes the individual payments for you.

- Debt Consolidation Frisco

Debtors are advised to choose to take a new loan with a lower interest rate and pay off their high-interest debt.

- bankruptcy

In case one is unable to meet their financial obligations, they may be able to file for bankruptcy and protect exempt assets. Those forced to file a chapter 13 bankruptcy may still have to repay their debts.

It is important to make a wise decision when choosing a debt counselor for better decision-making. Counselors offer advice that will enable you to come up with a suitable way how to manage your debts.

Having an Unrealistic Budget

While having a plan is good, if it’s not even close to realistic, that plan will fail. Add a little bit of wiggle room for financial emergencies. Don’t designate all your extra cash toward the monthly payments. That won’t be possible. By leaving a little wiggle room, though, you make it easier to follow the budget.

Not Exploring Your Options

Debt consolidation isn’t the only option you have. You can also check out debt relief in Frisco, Texas. Different financial strategies can help you determine why consolidating your debt is the best move to make. A debt relief program can negotiate the balances of your existing loans and provide a much lower program payment compared to a minimum payment of high-interest debt.

Agreeing to a Higher Rate

One of the primary reasons borrowers love debt consolidation is the lower interest rate it gives you. That makes it possible for you to save on interest payments in the long run. However, if that isn’t possible given your credit score, you might agree to a higher interest rate instead. That’s not the ideal choice for you as it cancels out one of the most significant benefits of the loan. Consider other financial strategies that work better in solving your debts.

Not Paying Your Debts Right Away

When you apply for a loan, it doesn’t mean that the debt goes away. A lot of borrowers are blinded by the thought that they now have money to pay off those debts. But that’s not the case. In fact, you also need to have enough money to cover the charges associated with the loan. That’s why when you receive the money in your account, you should pay off the multiple debts you have right away. If you don’t and use the money for something else, you’ll only have bigger problems.

Spending More

You’re already having trouble with your current debts. Don’t add more to the pile. Stop splurging and using your credit card until you’re debt-free.

Debt Consolidation Loan Alternatives

Debt settlement and credit counseling can help you to manage and resolve debt without the need for a new loan. These programs are not ideal if you are trying to protect a high credit score in the short term. But if you need to get out of debt and save money on a monthly basis, you could resolve debt in under 5 years without a new loan. Debt settlement is usually the least expensive option. Always research a company and check the Better Business Bureau.

How to Receive Debt Consolidation in Frisco, Texas

The fastest way to get help is to call to speak with a Texas Debt Specialist now. You may also fill out the form above and one of our Texas Debt Specialists will reach out to provide you with a free and no-obligation consultation for Debt Relief or Debt Consolidation in Frisco, Texas.

Affordable Debt Consolidation Frisco Texas

- 469-663-6222

-

Affordable Debt Consolidation Frisco Texas

6136 Frisco Square Boulevard, Suite 400, Frisco, TX 75034

Hours of Operation

- Mon - Sat: 6 AM – 10 PM CT

- Sun: 7 AM - 10 PM CT

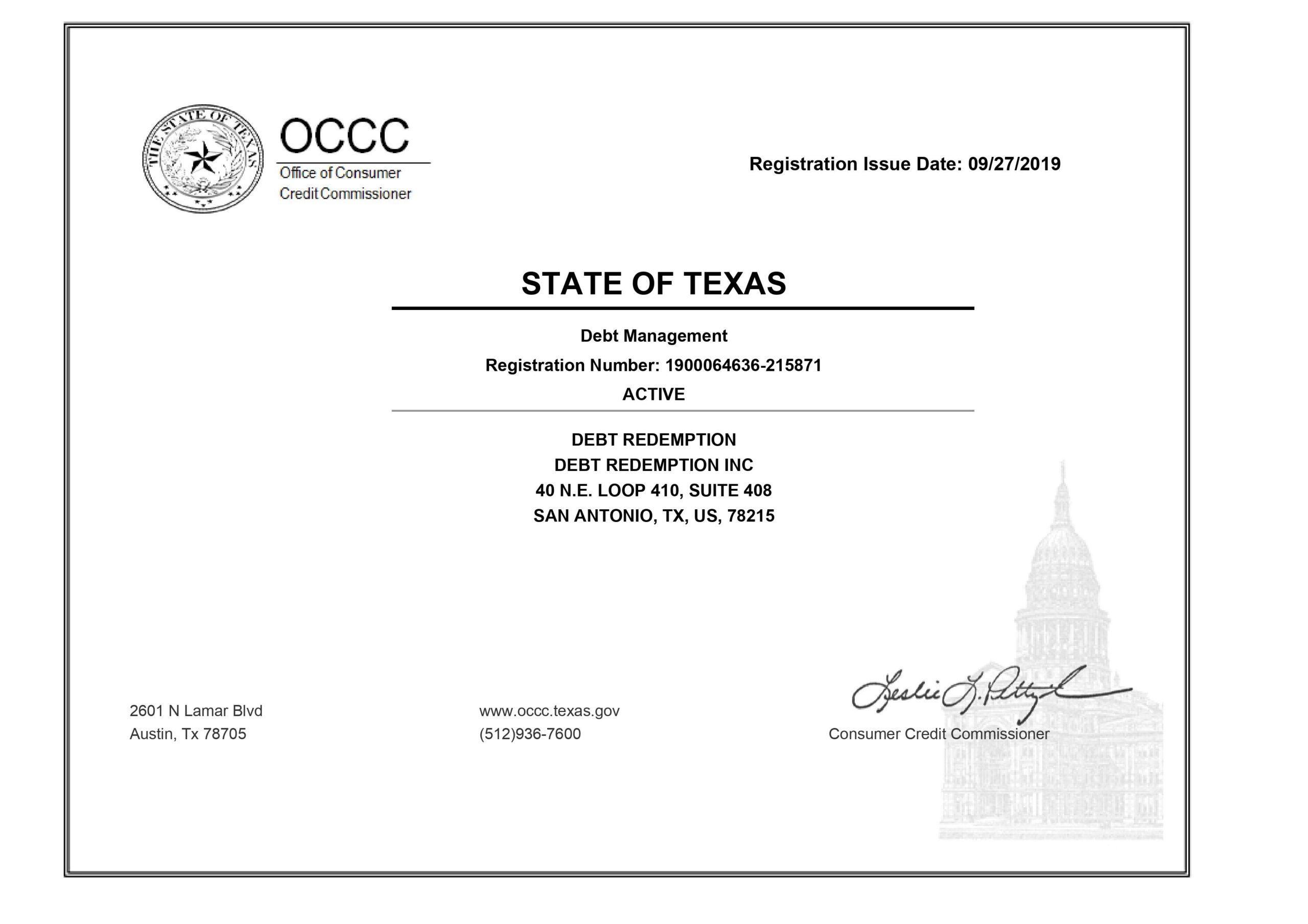

Texas Debt Management License

Debt Redemption License

Debt Consolidation Frisco, Texas, Credit Counseling Frisco, Texas, and Debt Relief Frisco, Texas Consultations are Free of Charge with no obligation. Affordable Debt Consolidation is not a lender but offers a platform to receive offers from participating lenders. Credit counseling clients generally obtain an interest rate between 6% and 11%. Debt negotiation clients who make their scheduled monthly program payments generally experience approximately a 45% reduction of their enrolled balance before fees over a 24-48 month period, not including any optional and separate services such as legal services provided by a law firm. Our settlement fees are 15% of the enrolled balance compared to 25% charged by most competitors. Individual results vary based on the ability to fund the program, and the creditors enrolled. Statements made are examples of past performance and are not intended to guarantee that your balances will be reduced by a specific amount or that you will resolve debt within a specific time period. Settlement fees are not charged until a debt is reduced and payment has been made to the creditor. We do not assume consumer debt, make monthly payments, or provide tax or legal advice. We are not a credit repair firm. Please contact a tax professional to discuss any possible tax consequences of paying less than the total balance. Debt Relief programs are exclusively offered to Texas residents. Logos used are property of their respective owners.

Privacy Policy | © Copyright Affordable Debt Consolidation Frisco, Texas 2024 | All Rights Reserved | Sitemap