*Please use the slider to select your debt amount

or Talk to a Texas Debt Specialist 832-648-3555

or Talk to a Texas Debt Specialist

832-648-3555

Eliminate high-interest Credit Card Debt in as little as

24 - 48 months

Eliminate high-interest Credit Card Debt

in as little as 24 - 48 months

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for reduced interest or negotiated balance reductions

- Call: 832-648-3555 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

- Our Texas Debt Relief service is usually 40% LESS than out-of-state competitors

- Low monthly program payments with no new loans needed

- Options for interest reductions or negotiated balance reductions

- Call: 832-648-3555 now to ask your Texas Debt Specialist about our $1,000 Visa Gift Card lowest fee guarantee

- Facing a creditor lawsuit? Call us ASAP for affordable assistance.

- Use our affiliate platform to shop Credit Card Debt Consolidation Loans up to $100,000 in Abilene, Texas. Review offers from multiple lenders without a fee or any impact on your credit score.

Debt Settlement in Baytown, Texas: Risks You Need to Know

Debt settlement is one of the many strategies to help you regain control of your finances. Are you hiring a team company to help you with that? It’s wise to fully understand the process and its meaning. Here’s what you need to know before you go with this approach.

Affects Your Credit

Going delinquent on your debt, whether in a debt settlement or not, will negatively impact your credit. When you work with a company for debt settlement in Baytown, Texas, they will advise you to stop making payments. You collect the money into a settlement savings account and use it later to make a lump sum payment. Debt companies ask you to do this before they make an agreement with the creditor. If you are already delinquent or if you feel you may be delinquent in the coming months, then a debt settlement program could save you a lot of money and help you.

Interest and Penalties May Be Added

Interest will accrue whether you make payments or not. After about six months of delinquency, interest will usually stop accruing or slow down. However, a good debt settlement company will calculate this in when they quote you upon enrollment.

No Guarantee

The risk with debt settlement is that creditors are not required to reduce the amount that you. The vast majority of the time, they will do this if you are in a delinquent status. They would rather get some of the money rather than no money. Also, consider the fees charged by a debt settlement company. Most companies charge Texan 25% of your enrolled debt, although you can find a company based in Texas that only charges 15%. Keep in mind this is not interest, and the fees are spread over the length of the program. One factor that can tip the situation in your favor is to choose an experienced debt settlement service. They know how companies work and what approaches or strategies will work. When they talk to your creditor to ask them to agree to a debt settlement, the more persuasive they are, the more advantageous for you. With professional help, you can look forward to a successful debt settlement. Research the Better Business Bureau for a longstanding and reputable company based in Texas that can assist you.

How to Receive Debt Consolidation in Baytown, Texas

The fastest way to get help is to call to speak with a Texas Debt Specialist now. You may also fill out the form above and one of our Texas Debt Specialists will reach out to provide you with a free and no-obligation consultation for Debt Relief or Debt Consolidation in Baytown, Texas.

Affordable Debt Consolidation Headquarters

Hours of Operation

- Mon - Sat: 6 AM – 10 PM CT

- Sun: 7 AM - 10 PM CT

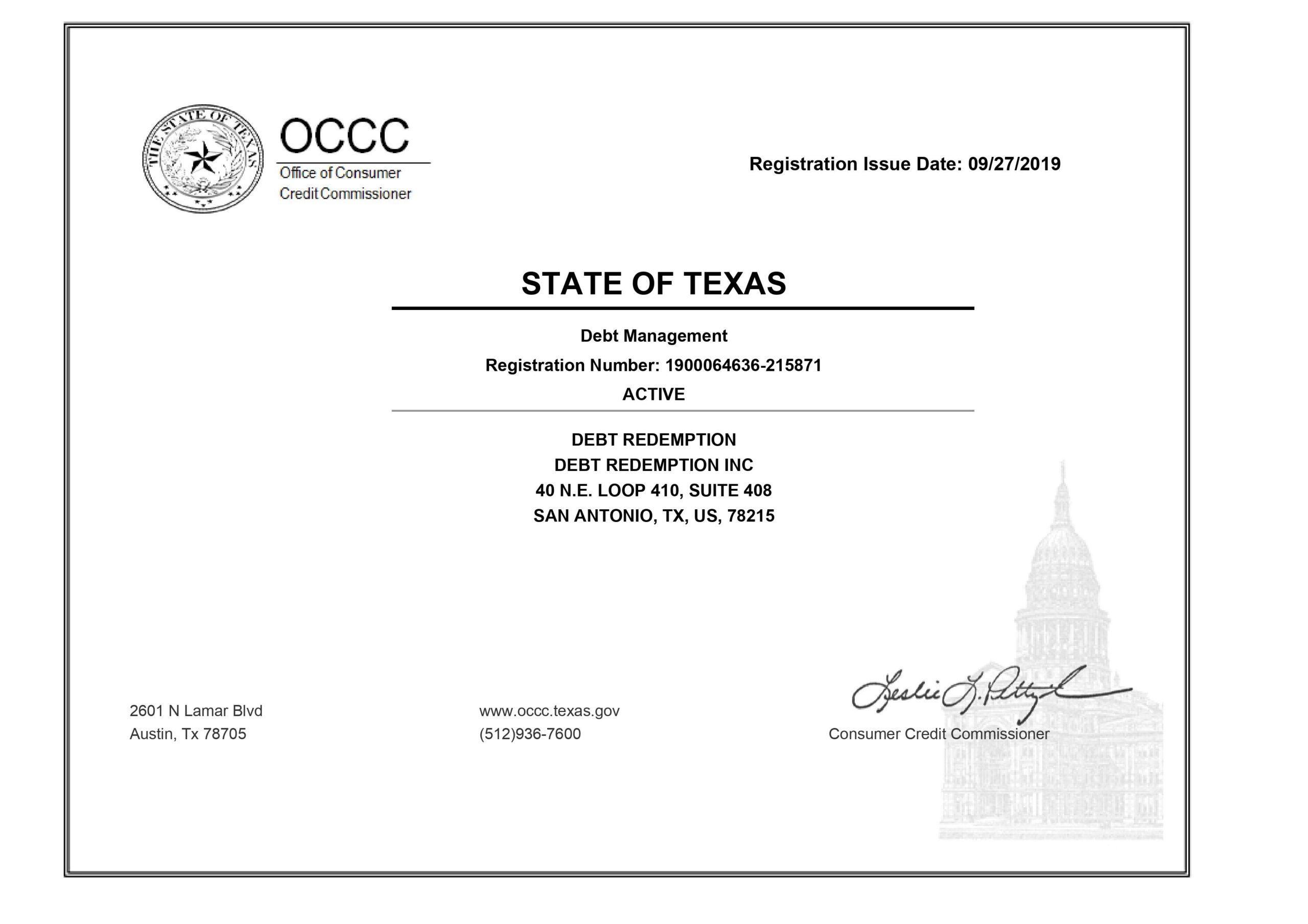

Texas Debt Management License

Debt Redemption License

Debt Consolidation Baytown, Texas, Credit Counseling Baytown, Texas, and Debt Relief Baytown, Texas Consultations are Free of Charge with no obligation. Affordable Debt Consolidation is not a lender but offers a platform to receive offers from participating lenders. Credit counseling clients generally obtain an interest rate between 6% and 11%. Debt negotiation clients who make their scheduled monthly program payments generally experience approximately a 45% reduction of their enrolled balance before fees over a 24-48 month period, not including any optional and separate services such as legal services provided by a law firm. Our settlement fees are 15% of the enrolled balance compared to 25% charged by most competitors. Individual results vary based on the ability to fund the program, and the creditors enrolled. Statements made are examples of past performance and are not intended to guarantee that your balances will be reduced by a specific amount or that you will resolve debt within a specific time period. Settlement fees are not charged until a debt is reduced and payment has been made to the creditor. We do not assume consumer debt, make monthly payments, or provide tax or legal advice. We are not a credit repair firm. Please contact a tax professional to discuss any possible tax consequences of paying less than the total balance. Debt Relief programs are exclusively offered to Texas residents. Logos used are property of their respective owners.

Privacy Policy | © Copyright Affordable Debt Consolidation Baytown, Texas 2024 | All Rights Reserved | Sitemap